Outstanding Info About How To Get A Tax Lien Removed

A federal tax lien can make it difficult for you to sell your house, refinance the mortgage or get credit until.

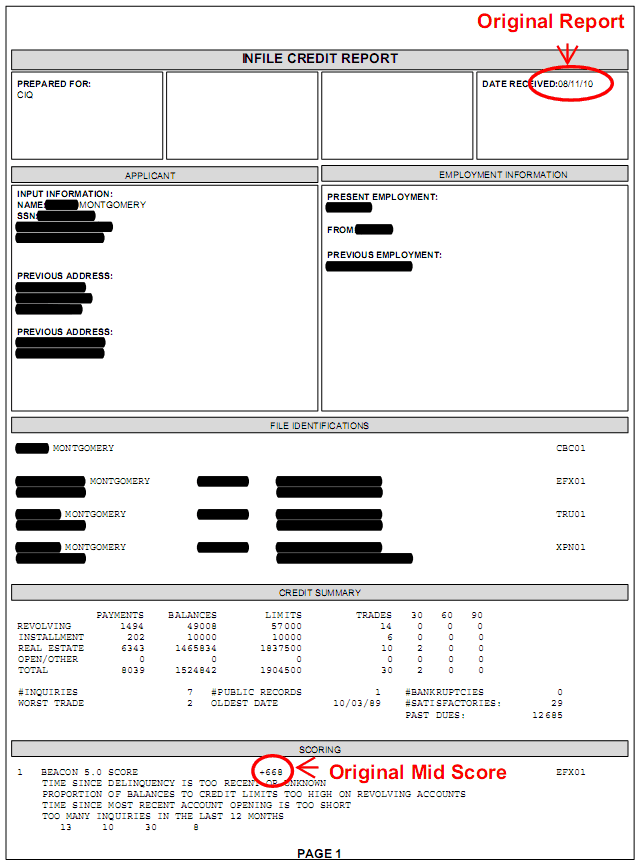

How to get a tax lien removed. First, the irs can withdraw the notice if our paperwork wasn't in order before we filed the notice. If you filed your tax return but have failed to pay your taxes, in all likelihood the irs has filed a tax lien against your property. If you have a tax lien listed on your credit report, it will appear as an entry under public records. you can access your credit report using a free online service, such as credit karma or credit sesame.

Are you wondering how do you get a tax lien removed? A lien is a security interest placed on property. If the irs attempts to do this to you, you’ll want to get advice from a tax attorney.

How to have a tax lien removed. Are you wondering how to remove a tax lien from a property in texas? The only way is to pay your property taxes.

The irs releases your lien within 30 days after you have paid your tax debt. All you need is the right patience, paperwork, and payment, and you can get your lien removed. Tax liens are public records in texas, and a creditor could see you as a credit risk because of the lien.

Second, sometimes when you're paying off your lien in installments, we might be able to withdraw the lien notice depending on the type of repayment plan you have. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. There are four ways allowed by law.

How do i get rid of a tax lien? How to get rid of a tax lien step 1: If you do, you can get the tax lien released.

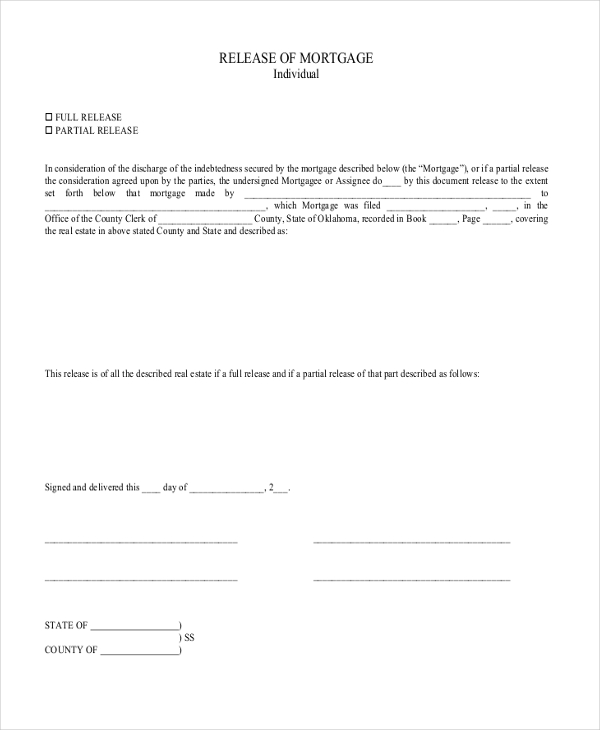

The only way to release a federal tax lien is to fully pay the tax owed or reach a settlement with the irs. A levy is a method of collecting a tax debt owed, often by taking the money from a bank account or paycheck. Your first goal is to pay off your tax liability.

The irs releases a tax lien thirty days after the tax bill is paid in full. All three major credit reporting agencies decided to drop tax liens from their reports. The ideal way to release the tax lien on your property is.

Whether it's from the irs or the local county, there are different ways you can clear these on your property. An irs tax lien notice can be removed from your credit report before the full seven years has elapsed. How to get a tax lien removed (in 3 steps) once you have all the correct paperwork and the finances to pay off the lien, removing a lien is simple.

An oic, or offer in compromise, is an offer to settle your back taxes for less than the. Resources taxpayer rights related content what do i need to know? A tax lien is simply a document issued by the irs (or another organization) that represents “the government’s legal claim against your property when you neglect or fail to pay back taxes,” according to the irs.gov website.